DIE ALL-IN-ONE SOFTWARE FÜR IHR SPORTWETTEN BUSINESS

Wir bei Arland entwickeln seit 24 Jahren Software für die Bedürfnisse

der modernen Sportwetten-Branche. Unterstützt durch unser unschlagbares Partnernetzwerk decken wir die Anforderungen von Unternehmen verschiedenster Größen mit flexiblen und leistungsstarken all-in-one Lösungen ab – von individuellen Frontends bis hin zu optimierten Marketing- und Verwaltungstools.

Unsere Sportwetten Software - Ihre unbegrenzten Möglichkeiten

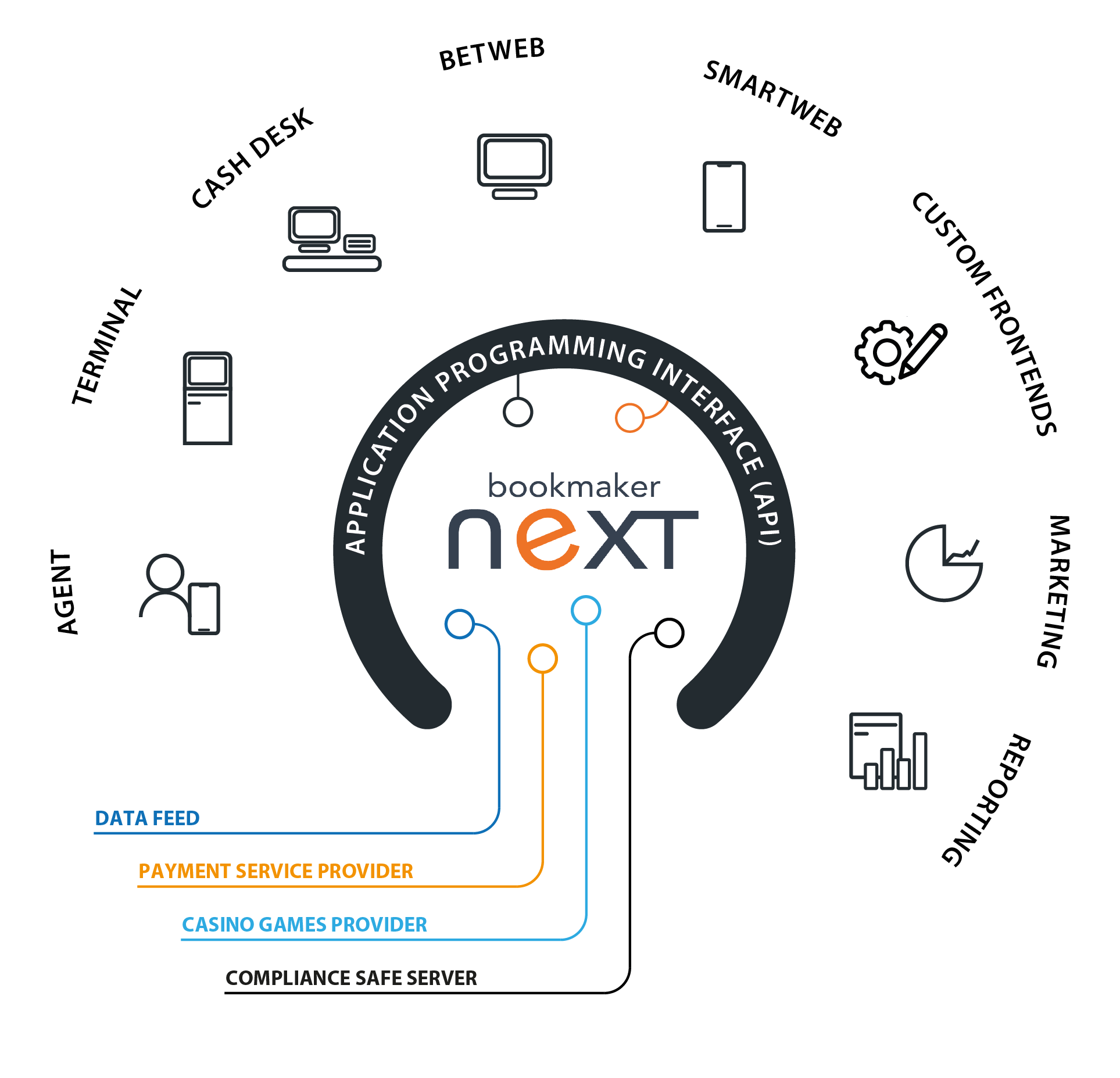

Mit unserer neuesten Software Plattform Bookmaker NEXT haben wir unserer Leidenschaft für Technik & Sport, und unserer langjährigen Branchenerfahrung Form verliehen. Höchste Flexibilität, innovative Frontends und mächtige Verwaltungstools – weg von alten Insellösungen hin zu einer offenen und zukunftssicheren Architektur unter Einsatz modernster Technologien.

Differenzierung

_____

Optimales Content Management

Wettangebot

_____

Beste Events & Quoten

Bonus & Promotions

_____

Marketing: der Schlüssel zum Erfolg

Wettstrategie

_____

Risikomanagement: Erfolgsoptimierung

Starke Synergien für den Erfolg Ihres Unternehmens

Wir begleiten Sie in allen Phasen Ihres Projekts

Egal ob Sie noch ganz am Anfang Ihres Projekts stehen, oder bereits ein etablierter Wettanbieter sind – als Partner begleiten wir Ihr Projekt in jedem Stadium mit Rat, Tat und Diskretion. Auf unserer Arland Knowledgebase finden Sie bereits vorab Checklisten, Case Studies und viele wissenswerte Inhalte für alle Phasen Ihres Projekts. Erfahren Sie jetzt aus erster Hand wie erfolgreiche Sportwettunternehmen arbeiten!

„Um in einer so dynamischen Branche wie dem Sportwetten erfolgreich zu sein, reicht es schon lange nicht mehr aus, lediglich den gleichen Weg wie alle anderen zu gehen. Innovation und die richtigen strategischen Partnerschaften sind der einzige Weg um sich heute noch auf dem Markt abzuheben. Unsere Aufgabe ist es, unsere Kunden nicht nur mit einer erstklassigen iGaming-Plattform, sondern auch mit unserer langjährigen Branchenexpertise zu unterstützen und gemeinsam nachhaltig zu wachsen.“

Felipe Andrade da Silva

CEO von Arland Technologies

Lernen Sie Bookmaker NEXT kennen

Lassen Sie uns Ihnen zeigen, wie einfach Sportwetten sein kann. Melden Sie sich heute noch für eine kostenlose Demo von Bookmaker NEXT an und profitieren Sie von 23 Jahren Know-How für Ihr Projekt.

Neues aus der Branche

_____

Arland Technologies strebt nach einer Führungsposition im B2B-Segment auf dem regulierten brasilianischen Markt

Das Unternehmen für Sportwetten- und iGaming-Software, Arland Technologies, hat die Beschleunigung seiner Marktstellung im rasant wachsenden Online-Gaming-Geschäft in Brasilien bekannt gegeben. Arland ist seit 2014 im florierenden südamerikanischen Markt präsent und hat kürzlich einen vierten regionalen brasilianischen Betreiber unter Vertrag genommen, wodurch seine führende Position im Segment weiter ausgebaut wurde. Mit seinem wachsenden lokalen Kundenportfolio

Let’s meet at ICE London 2022

Die moderne Digitalisierung stellt die Sportwettenbranche vor neue Herausforderungen. Nie war es für Wettanbieter wichtiger als heute, sich an aktuelle Trends und neue Anforderungen anpassen zu können. Für eine derartige Flexibilität müssen jedoch die richtigen Rahmenbedingungen geschaffen werden. Um den Status Quo zu hinterfragen, etwas Neues zu schaffen und neue Märkte zu erschließen müssen Sie eine eigene

Erfolgreiches Risikomanagement im Sportwetten

Risikomanagement stellt das Rückgrat jeder Sportwetten-Operation dar. Es macht den Betrieb eines Wettunternehmens zu einem tragfähigen Geschäftsmodell anstelle eines buchstäblichen Glücksspiels. Geschulte Buchmacher sind in der Lage, sowohl das Angebot an Ligen, Events und Tipparten auf den Zielmarkt anzupassen. Darüber hinaus haben sie die Aufgabe, das Risiko zu managen und dadurch Sicherheit und Profit für